1,069 views

1,069 views 1698 Views

1698 Views  4 min read

4 min readOne of the biggest obstacles Health Insurance and Payment salespeople face is shortening the long sales process. As you know, unlike B2C, the B2B sales process includes involving many decision-makers and informing them of the value of your service. It usually takes a long time to convince all of them that your remedy will best meet their needs. Since everyone has a different opinion and since so many people are involved, this makes the sales cycle incredibly long. According to a current study by Demand Gen, the Buyer’s Journey for many B2B buyers is getting longer and a lot more challenging, which does not help the already laborious sales process. But there is a bright side. There are many strategies that could help you reduce your sales cycle in your Health Insurance and Payment Sales process:

Don’t make the mistake at trying to engage with unqualified leads. You could find yourself in a long sales cycle that doesn’t produce any leads or sales. Before starting the sales process, take time to identify who you are targeting. Your Buyer Personas (also known as your ideal buyers) could be ‘Physician Philip’, ‘Hospital Administrator Alice’ or ‘Medical Director Daniel’. Ideally, your Buyer Personas need to be the decision-makers of the companies you are targeting, and sometimes influencers. After determining your Personas, you could outline their top qualities by asking the following questions:

The answers to these questions will give you a better idea on how to approach them.

Usually, leads only know how a salesperson looks after the first in-person meeting. To develop a connection before the first meeting, think about sending an introductory video talking about why you have an interest in them (flatter), something useful to them (research you did), and a call-to-action (Let’s set up a time to continue the conversation). By doing this, when you engage them by phone, they know more about you. This does not mean that you should spend a lot of time on this video. A good smartphone camera with quality lighting will do. We like to use Soapbox by Wistia.

Don’t make the mistake of having a sales consultation with a potential customer without giving them information to engage with. This means that you could need many visits before convincing the prospect, but that could take a lot of time that you don’t have. Instead, send out Lead Nurturing Emails that include helpful content they could look at before your meeting. For instance, if you want to sell X-Ray equipment to “Hospital Administrator Alice,” send her a link to a blog post with data on how managers save time with new medical technology. You can also send comparison charts that show the benefits your company provides over your competitor. Keep strategically connecting with your potential customers throughout the process to position yourself as a top resource.

After the first visit, the prospect will probably have some questions or concerns. Your role as a sales rep of your Healthcare Insurance and Payment business is to resolve these problems and remove any hurdles. You could send out follow-up emails with reports, case studies, or videos that answer these questions. This content could be used to assist other leads, too. Getting over barriers using content will help shorten the sales cycle dramatically.

Potential customers want to know about the pricing of your products and services. But a lot of salespeople skirt around the issue of pricing until late in the sales process. This only adds more time to the sales cycle, and you don’t want that. Additionally, if you don’t share this information up front, it may cause you to lose customers. Be open with the rates early in the sales process to save you from trouble later on. So how do you share this information without scaring leads away? Be sure to share the value your option supplies, so the cost is considered in context. You could also use phrases like “starting at $…” or “from $…”

Social proof can help you win your prospect’s trust faster and seal the deal more quickly. You might send them a case study showing the ROI of your product or service. The business showcased in the study should resemble the prospect’s company. You could also look for a common link on LinkedIn who could refer you. This strategy is more effective than just sending out a random email. According to the B2B news network, 84% of B2B decision-makers start the buying process with a referral. You can also invite the prospect to a live event to connect them to your current customers. Then, they’ll be more likely to make a speedy buying choice.

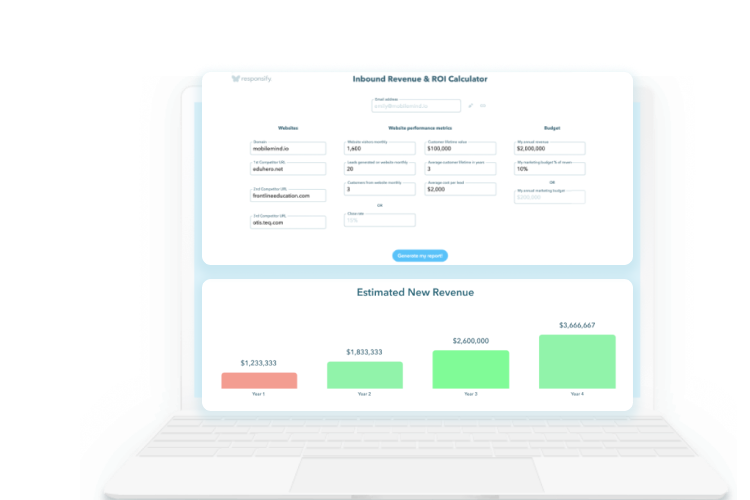

Although you may be laser-focused on closing sales and meeting your goals, it’s also important for you to take time to recognize your leads in and out. Your sales cycle needs to be aligned to the lead nurturing process where you function as the expert for your potential customers all while building trust and boosting the chances for sales. But this is a lot of work to do alone. Responsify partners with Health Insurance and Payment sales and business development pros to offer strategy, support, and help in carrying out these tasks. By collaborating, we help marketing and salespeople tactically bring in brand-new website visitors, convert them to qualified leads, and produce happy customers. We’ve helped several sales pros like you integrate Inbound right into their sales procedures. If you want the same benefits, schedule a cost-free strategy session to help you evaluate your methods and learn how to make them even better.