589 views

589 views 2071 Views

2071 Views  4 min read

4 min readThe Health Insurance and Payment sales process can take anywhere from a few weeks to months to maybe even years. From the sales professionals in the industry we talk to, eight months is the average we hear. According to a current report by Demand Gen, buying cycles have gotten much longer as there are more decision-makers in the B2B buying process. Buyers are also spending more time doing research before they buy, which means less explaining directly from salespeople, but the same length of sales cycle. Here are some ways to reduce the Health Insurance and Payment sales cycle:

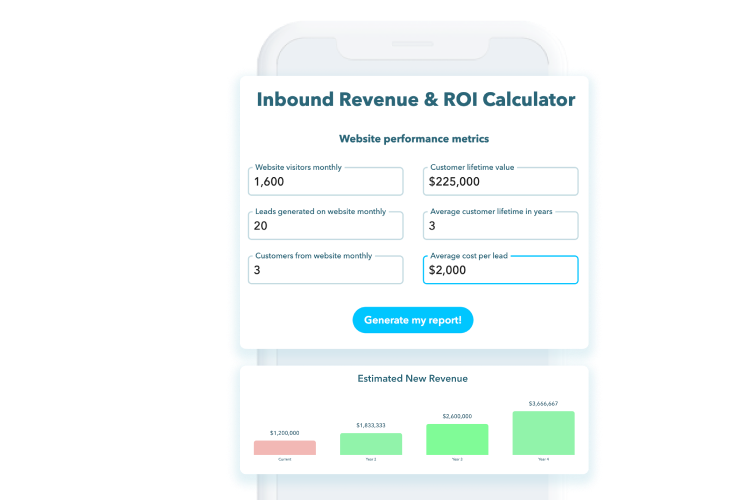

Your potential customers go through various phases of the Buyer’s Journey. Because of this, you need to make sure your sales content is matched to their corresponding phase in the journey. This will make it easier to inform them, move them to the next phase, and convert them into happy buyers. Awareness Phase: At the beginning of the sales cycle, your potential customers are not sure of exactly what they need. This is when potential customers try to identify their troubles that need to be resolved and what solutions they want. So, before establishing a sales meeting, be sure to offer the prospect with informational content that resolves their problems. This could be anything from content conveniently shared on your website like blogs or infographics to premium content like ebooks and whitepapers. As you help your leads recognize their issues, you could find out whether or not your Health Insurance and Payment services can help them. Doing so will help you establish the top priorities, then you can concentrate on helping leads that are enthusiastic as opposed to those who aren’t. Consideration Phase: Here, leads know their issues and have chosen how to resolve them. They are thinking about various options for overcoming their obstacles. You should share content with them that positions you as an authority in the industry and shows different services. Whitepapers, webinars, case studies, and overviews are great for persuading potential customers to buy from you and not your competitors. But keep in mind that the content in this phase should not point out anything about your specific Health Insurance and Payment firm just yet. It needs to concentrate on informing your leads and showing them the ideal steps to fix their issues. A good example of Consideration Phase content is BuzzSumo’s webinar series where leads can get suggestions and techniques from different marketing experts. Decision Phase: In this phase, your leads have chosen which approach they’ll need to take to satisfy their demands. They are contrasting the advantages and disadvantages of different offers from various Health Insurance and Payment businesses and trying to choose which one is best for them. Content like videos, comparison charts, trials, and item summaries are great for this phase. Other ways to leverage content are industry-specific case studies, blog posts, and online calculators that help your Health Insurance and Payment leads compute the return on investment from your solutions.

According to the 2017 Salesforce State of Marketing report, 67% of marketing and sales leaders use automation software applications. It also mentions that over the next two years, an additional 21% are going to start using an automation system. You can reduce your sales cycle dramatically by automating your work. For example, instead of manually releasing social media posts and sending out Lead Nurturing Emails, you could use software automation programs to do it instantly. The content use in your automation emails and social media posts will help nurture your leads and make it easier to convert them into customers. Automating your sales initiatives will not just reduce your sales cycle but will also reduce the sales costs per lead. Automation also helps you maximize your time and lets you concentrate on other important tasks in your busy schedule.

One of the first things a prospect will like to know is the cost of your product or service. If Your Health Insurance and Payment software application is known for being competitively priced, you can include a “Request a quote” button on your website. This could help you start the conversation to get the information you need from the lead before you provide the cost. Then, you can show the value of your product. This helps you be receptive to energetic leads in the Decision phase of the Buyer’s Journey and decrease your sales cycle dramatically.

Health Insurance and Payment sales cycles can take a long time, and it’s important to reduce the cycle for everyone on your list. The tips above are part of the Inbound Sales Methodology and will help you plan how to attend to the needs of your leads throughout the sales cycle. But it can be difficult to do all of this alone. We at Responsify work with Health Insurance and Payment sales and business development pros to offer strategy, support, and help in executing these tasks. By collaborating, we help marketing and salespeople strategically draw in brand-new website visitors, convert them to qualified leads, and then speed up the closing process. We’ve helped lots of skilled salespeople weave the Inbound Methodology into their elaborate sales process. Don’t hesitate to schedule your free strategy session to help you assess your methods and find ways to reduce your sales cycle.