745 Views

745 Views  4 min read

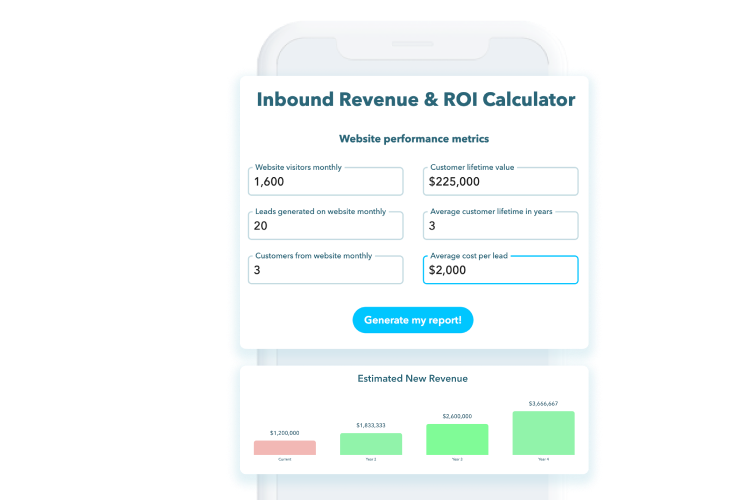

4 min readWhat Health Insurance and Payment business CEO, President, or Management Director doesn’t want to see growth in their earnings. In a competitive landscape, with long sales cycles, one of the best ways of increasing the revenue is by using a unique marketing and sales approach called “Inbound.” According to Hubspot, 49.7% of companies using Inbound marketing and sales boost their sales within seven months. Traditional marketing and sales strategies like print ads, website pop-ups, self-promotional emails, trade shows, cold-calling, and basic product demos mean advertising your brand name to people who might not even be interested in your Health Insurance and Payment service right now. On the other hand, Inbound brings in qualified individuals using informative content that helps meet their needs. Inbound strategies bring in more web traffic, produce brand name recognition, improve the sales process, and improve your earnings. Here are six ways to increase your earnings in the Health Insurance and Payment sector

Ideal customers vary for every business. A buyer persona is an imaginary personality that represents your Health Insurance and Payment company’s ideal customer. A better understanding of your buyer identities will help your marketing and sales teams develop content that meets the identities’ needs, which will help draw in more leads and boost customer close rates. It’s critical to think about the following when building your Buyer Personas. Success Factors: What variables does the prospect relate to success? Perceived Obstacles: What organizational or personal obstacles would cause the prospect to pick your competitor? Change Drivers: What will cause a change in the prospect’s habits? Buyer’s Journey: What questions does the buyer ask throughout the process? Priority Initiatives: How does the prospect spend their time and money? Decision Standards: How does the prospect make a decision?

After developing Buyer Personas, you can work with your marketing and sales teams to build a content strategy that will bring in new people to your site, convert them to leads, and then transform them into customers. Make sure your content addresses the common questions asked by your potential customers are asking and include key phrases that they search online. Regularly posting optimizing content will help boost your search engine position and bring in more organic traffic. It will also develop your Health Insurance and Payment company as an authority in the industry and help win the trust of leads. You can produce content like blogs, ebooks, whitepapers, infographics, reports, and case studies that will inform your leads and draw them in even more. Sharing your content on social media will help you get to a larger target market and improve the opportunities of growing your revenue.

What’s the point of growing your web traffic if once they get to your site, they leave and never return? You need to convert these site visitors into leads by gathering their contact information. To do this, you need to create a landing page where new visitors can give their information in exchange for premium content like ebooks, whitepapers, or reports. Make sure your calls-to-action are engaging and produce a feeling of urgency. “Download your free report now!” and “Get your free ebook today” are examples of well-crafted CTAs. A report from Hubspot found that businesses that have 40 or more landing pages get 12 times more leads than those that have five or less.

After getting their contact information, your sales team needs to take time to continually nurture your leads using email until they convert into clients. You can use tools like Marketo, Eloqua, Customer.io, Constant Contact, and Hubspot to automate your lead nurturing projects. To make the most of click-through rates, make sure the emails have customized “From” areas that have your salespeople’s names and emails. The subject lines need to be entertaining and clear. Don’t forget to include a CTA in your emails and in a good position so people are more likely to click. To get to an even bigger audience, your emails should have social sharing links. Many email marketing tools have templates that feature social sharing buttons. One of the most important things to remember is to show value. Send out clips to blog write-ups and premium content that aligns with the buyer persona of the recipient.

According to ComScore, people invest about 69% of their media time on their phones. As a result, it’s important to enhance your site for smartphones just as you would for a desktop computer or tablet. Your web developing team should make sure CTAs are visible and placed above the fold to make them noticeable on smartphone web browsers. The content needs to be kept brief and not filled with photos. Text on phones should be big enough for people to see without hurting their eyes. Pop-ups and flash should be turned off to not distract visitors from your content and navigation should be intuitive.

To optimize your return on investment, be sure to evaluate your marketing metrics like overall site views, channel-specific traffic, bounce rate, conversions, close-shut ratios, customer retention rates, and customer acquisition rates. Checking these metrics will show you what is working and what isn’t. Tools like Mixpanel, Heap Analytics, Kissmetrics, and Kapost’s Content Scoring are great for measuring metrics.

Revenue growth is important for any company, and it doesn’t just happen overnight. Unless you concentrate your marketing and sales initiatives to the right target market, it can be challenging to close more sales and grow your income. Nevertheless, with Inbound Marketing and Sales, you will have the chance to bring in qualified leads, nurture them to customers, and turn them into happy clients of your Health Insurance and Payment product. We’ve helped many firm leaders to boost their marketing and sales procedures by integrating an Inbound strategy. Don’t hesitate to book your complimentary strategy session to help you evaluate your current processes and find ways to grow your revenue.